Liminal.market is designed to provide a user-friendly interface for buying and selling securities. The process is streamlined and intuitive, similar to the experience on platforms like Uniswap. Below, we outline the steps involved in executing buy and sell orders on Liminal.market.

Buy Order Process

The process of buying securities on Liminal.market is straightforward. In this example, we'll illustrate the steps involved in purchasing $100 worth of Apple (AAPL) stock:

You can try it at app.liminal.market

- The user selects the desired security (AAPL) and specifies the amount to buy ($100) on the Liminal.market interface.

- The user initiates the transfer by executing a transaction from their aUSD token to the AAPL token for $100.

- Liminal.market burns 100 aUSD tokens from the user's wallet.

- Liminal.market sends the buy order to the broker for execution.

- The broker executes the order and confirms the transaction.

- Liminal.market receives a notification that the order has been successfully executed.

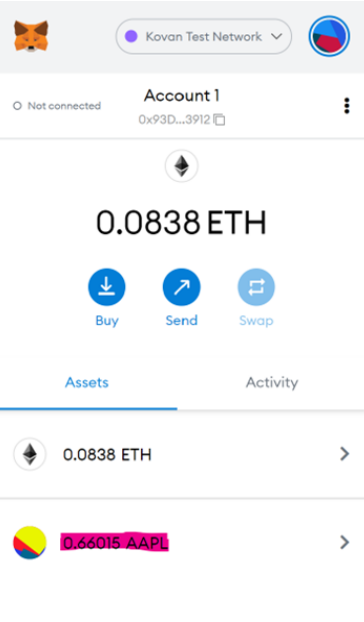

- Liminal.market records the transaction on the blockchain, indicating that the user's wallet now owns $100 worth of AAPL stock, represented as a token. For example, if the price of AAPL is $151, the user receives 0.66015 shares (i.e., $100 / $151).

The user's wallet now reflects ownership of 0.66015 shares of Apple.

The wallet now has 0.66015 shares of Apple

Sell Order Process

The process of selling securities on Liminal.market is equally simple. In this example, we'll illustrate the steps involved in selling the 0.66015 shares of AAPL stock that the user previously purchased:

- The user selects the security (AAPL) they wish to sell and specifies the amount to sell (0.66015 shares) on the Liminal.market interface.

- The user initiates the transfer by executing a transaction from their AAPL token to the aUSD token for 0.66015 shares.

- Liminal.market burns 0.66015 AAPL tokens from the user's wallet.

- Liminal.market sends the sell order to the broker for execution.

- The broker executes the order and confirms the transaction.

- Liminal.market receives a notification that the order has been successfully executed.

- Liminal.market mints 100 aUSD tokens and credits them to the user's wallet.

The user's wallet now reflects a balance increase of 100 aUSD tokens.

Overall, Liminal.market's streamlined order flow ensures a seamless and efficient experience for users when buying and selling securities on the platform.

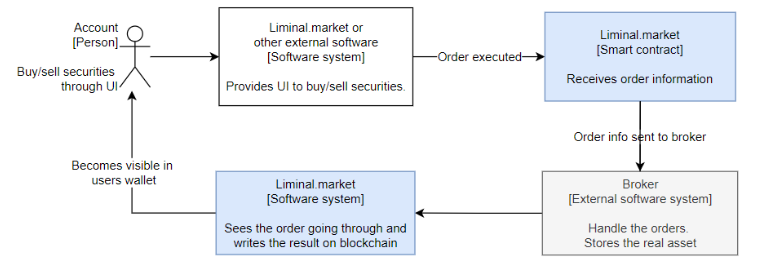

The Liminal.market Buy and Sell Process Flow

The flow begins with the user selecting the desired security and specifying the order type and amount. The user then initiates the transfer, and Liminal.market handles the subsequent steps, including token burning or minting, order execution through the broker, and recording the transaction on the blockchain. The flow ensures transparency, security, and ease of use, allowing users to confidently manage their investments on the platform.